The financial rating of Pure Fishing has been downgraded by Moody's Investment Services long-term ratings to a "Very High Risk" of default on corporate debt according to a report in Angling International and other outlets.

Pure Fishing is a leading global provider of fishing tackle, lures, rods and reels with a portfolio of brands that includes many of the best-known names in U.S. fishing, including Abu Garcia, Berkley®, Fenwick®, Greys®, Hardy®, Hodgman®, Johnson™, Mitchell®, Penn®, Pflueger®, Sebile®, Shakespeare®, SpiderWire®, Stren®, and Ugly Stik®.

|

In 2018, Newell Brands sold Pure Fishing to Sycamore Partners, a leading private equity firm specializing in consumer, distribution and retail-related investments. The company reportedly sold for $1.3 billion.

The company’s debt balance sheet reportedly doubled over the past two years, in part due to funding the acquisitions of Plano Synergy in April 2021 and Svendsen Sport in February this year. Since 2021, ongoing cash flow deficits also contributed to higher debt, per the report. Hopefully the acquisitions positioned them to benefit from even greater economies of scale, but that remains to be seen.

Moody’s noted that in late fiscal 2022 and early 2023, Pure Fishing completed a series of transactions to improve its liquidity, which included entering into a $60 million property loan due October 2024, secured by the company’s North American real estate and provided by its financial sponsors, Sycamore Partners. The company also obtained a $50 million promissory note due until February 2027 to fund working capital and for general corporate purposes

Pure Fishing has also announced changes to its executive management team, with CEO Harlan Kent stepping down but remaining on the board. Dave Allen of Sycamore Partners is replacing him. Allen is reportedly a turn-around specialist for middle market private equity portfolio companies and has been in the consumer products industry for over 30 years.

The company has also implemented productivity improvements aimed at labor cost reduction and production efficiency improvements.

Angler Numbers Stable

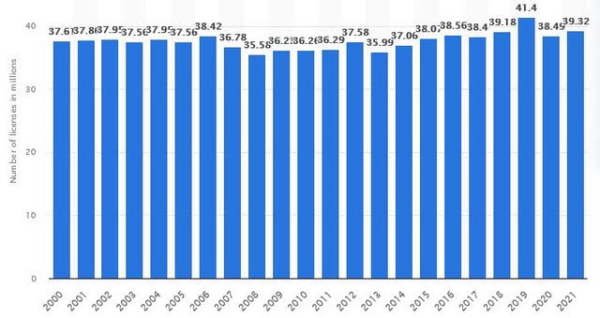

The hiccup is not apparently related to the number of anglers who are out there buying tackle, which has remained surprisingly stable for the last 20 years or more, varying between a low of around 35 million during the 2008 economic crash and for several years after, to a high around 40 million during the height of covid, when many had time off work and government cash to spend.

Boat sales boomed at the same time but have since slowed, with some dealers now reporting too much inventory and too few customers.

NMMA says there are 17 million boats registered in the U.S., and another 4 million unregistered. The latter number is growing rapidly due to the proliferation of kayaks and standup paddleboards. Pontoon boats have also continued to be a strong seller in most markets.

Selling to a New Generation

To be sure, the industry faces headwinds, not the least of which is the "screen generation" now growing into adulthood having rarely paid much attention to anything outside the digital world. The aging of the current generations of anglers, with some dying or getting too old to fish is surely a consideration.

While tournament bass angling is a growing business among college and even high-school kids, it's very limited. The masses of young people are not going fishing in numbers they once did, perhaps because their parents are also not going fishing or boating.

The American Sport Fishing Association (ASA) is taking a pro-active approach to the potential for a slowdown in angling interest. Earlier this year they assisted in passage of federal legislation to create a grant program to fund community-based programs that take children on fishing trips in coastal or Great Lakes waters. This bill would give access to the water to youth who otherwise may never learn to fish or appreciate the outdoors. It could be a good first step towards encouraging kids to fish.

The bill would create a $2 million grant program within the National Oceanic and Atmospheric Administration (NOAA) for projects that take children fishing in the ocean or Great Lakes, with priority given to projects that serve underserved communities.

This is that rarest of creatures these days, a bill with support from both Republicans and Democrats, so it might actually pass--though who knows, as the 2024 election looms. In any case, you can possibly help by contacting your legislators and indicating support.

The National Marine Manufacturers Association (NMMA) has also taken note of the need to keep a close eye on Washington developments, announcing this week plans to move their headquarters to DC.

Meanwhile, let's hope Pure Fishing's challenges are not a harbinger of things to come in the industry, but let's also keep our eyes open as we plunge deeper into the age of ChatGPT and the digital world.

— Frank Sargeant

frankmako1@gmail.com