Last Friday, a friend who happens to be in the gun business sent me a link to an advertisement with a simple question: how low can they really go?

When I clicked the link on the ad, after a double take, I realized why he was asking. The link took me to an Ammoland advertisement offering a Bear Creek Arsenal BC-15 5.56 NATO Right Side Charging Handle rifle for…$299.99 with “FREE S&H Options.”

The ad went on to explain that it was a special deal at 37% off the $475.80 MSRP, a savings of $170. I was instantly skeptical. But I know that the Ammoland wouldn’t be offering anything that wasn’t legit. Consequently, it appeared I had evidence for a friend’s saying “you can’t give away an AR-style rifle right now.” Granted $300 isn’t free, but it’s certainly a long way from prices in the not-too-distant-past.

Curious, I went to the Bear Creek Arsenal website and lo-and-behold, there was the same rifle, “Limited Time Only” priced at $299.99. It was what I’d describe as “bone stock” and didn’t include a magazine or optics, but it looked to be fully capable of putting protein in the stew pot or discouraging unwelcome guests, whether they came calling on two or four feet.

It’s one thing to talk with industry folks about how difficult it is for companies that specialize in AR-style rifles to stay in business. It’s another to see proof that while there are still expensive models available, there are new base guns priced so low as to almost be disposable.

As Pete Brownell advised dealers Monday, it’s time to go through their inventories and “Cut to the Core…look at your inventory with a cold eye. If a product has not turned in 90 days, it is time to discount, bundle or move it.”

His reasoning is simple- and solid: “Free up cash.” The followup suggestion for retailers was also simple: “stick with products that earn their place on the shelf. Remove anything that relies on wishful thinking.”

Right now, AR-style rifles sales appear to be one of those “wishful thinking” items. So, too, are many of the higher priced items with increasingly slower sales. They’re all confirming signs that the moribund market’s here for the immediate future.

With few orders for modern sporting rifles hitting manufacturers desks a lot of smaller companies are feeling the squeeze. Majors aren’t immune to the sales drop (evidence the hammering public companies have taken over the past week), but they have something the niche players lack: diversity in their product mixes. They’ll get whacked, but they’ll be able to continue.

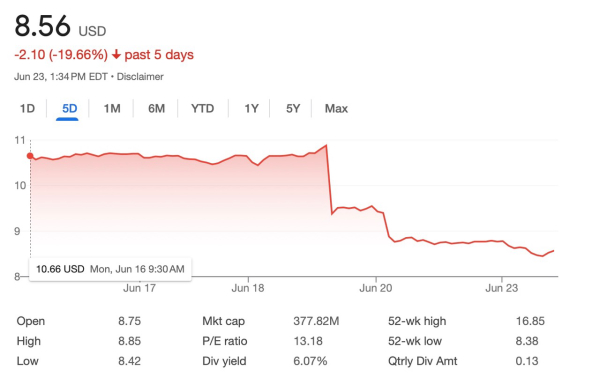

Last Friday, for example, Smith & Wesson Brands (NASDAQ: SWBI) shares dropped nearly 20% after the company’s Q1 revenues missed market expectations. The 11.6% drop in sales and non-GAAP profit of $0.20/share was thirteen percent lower than analysts expectation.

The explanation offered by S&W CEO Mark Smith said that despite disciplined cost management, the company simply couldn’t overcome “reduced consumer demand and changes in product mix.”

He also cautioned that there were “persistent headwinds,” listing inflation, tariffs and subdued consumer spending. It didn’t help that continued pressure on margins due to promotions and increased inputs costs -particularly on steel- would prevent further speculation on full year results.

Like others, S&W says they’re focusing on inventory management, cost controls, and the launch of new products to support its market position in “a challenging environment.”

For other companies, the challenge simply has proven too-tough to overcome. Smaller companies are increasingly shuttering, albeit quietly. Other more fortunate ones, are passing their businesses to other stronger groups.

The latest example happened on Monday, as longtime provider of gun parts like 1911 pins, grip bushings/screws, plungers and AR pins/plungers Performance Engineering of Hillsboro, Missouri formally became part of Wilson Combat’s LEHIGH DEFENSE.

In a letter to customers, Performance Engineering’s owners Russ and Darla Narzinski shared news that effective June 23,” all inventory, purchase orders along with blanket orders will be turned over to the new buyers.”

They also passed on some reassuring news for their customers: “ All pricing will remain the

same until the end of the year.”

Speaking with Bill Wilson about his latest acquisition, it was obvious he was more than happy to keep a company that has been supplying parts and pieces to the industry for more than 50 years going. He also told me the Performance Engineering lines would fit right into Lehigh/Wilson’s wheel house because of the ability to “economically manufacture any round part up to 5/8" diameter anyone would need with our 19 Star, 2 Tsugami single spindle and one high speed Tornos multi spindle Swiss machines.”

As always, we’ll keep you posted.

— Jim Shepherd