Welcome to 2026, the year of the horse—unless you’re in the firearms industry. And if you’re reading this, we assume you are. For you, 2026 is the Year of the Suppressor.

Thanks to Congress doing its job, and the President his, we have the elimination of the $200 Tax Stamp on short-barreled firearms and suppressors. Although the tax was not officially removed until Jan. 1, 2026, suppressor sales took off earlier, thanks in large part to companies absorbing the tax for customers.

Now that the tax is gone, it should be a free-for-all with suppressor sales going through the roof—at least in the short term. While the paperwork hurdles remain, faster approvals and the ATF’s proposed removal of the CLEO notification requirement—which alone adds seven days—mean the time from application to taking possession should shrink significantly.

This, of course, does not account for potential processing delays caused by a surge in eForm submissions, though one hopes the ATF’s NFA Division is prepared to meet demand.

Continuous Growth

Demand is certainly there. One suppressor manufacturer tells us dealers are already placing larger-than-normal orders in anticipation of a Q1 2026 consumer buying surge.

Rising demand is nothing new for the suppressor industry. Over the past 15 years, year-over-year growth has been impressive. Even so, the suppressor segment remains in its infancy when you view it by sheer product volumes.

The American Suppressor Association (ASA) was formed back in 2011, and at that time there were a total of 285,087 suppressors in circulation. That’s the total number over those 77 years since the National Firearms Act (NFA) became the law of the land in 1934.

According to Knox Williams, executive director of ASA, as of Jan. 2025 a little over 4.4M suppressors are in the National Firearms Registration and Transfer Record (NFRTR), the federal registry for NFA items.

When the ATF releases the final numbers for 2025, Knox expects that number will be north of 5M, though how far north will depend on how the $200 Tax Stamp news in July impacted the buying habits. Nobody yet knows how many consumers were waiting until January 1, 2026, to purchase versus those that took advantage of promotions where companies absorbed the tax to promote 2025 sales July through December.

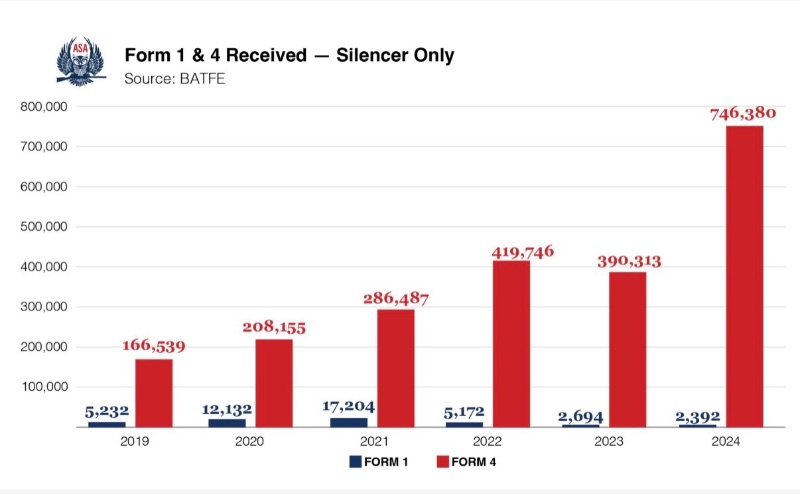

A study commissioned by the National Shooting Sports Foundation (NSSF) and conducted by Southwick Associates—Suppressor Owner Study: Market Size, Purchase Profile & Journey, Satisfaction 2025—found that the suppressor market saw 265% growth in suppressor Form 4 registrations from 2020 to 2024. During that same period, the total number of suppressors in circulation doubled.

For the uninitiated, Form 4 is the federal paperwork required under the NFA that covers the transfer of a suppressor. The Form 1 covers the creation of a suppressor. These same forms are used for other NFA items such as Short-Barreled Rifles (SBR) and Short-Barreled Shotguns (SBS).

The NSSF study also found that the overall suppressor market in 2024 came to $820M, with $156M of that in tax payments. Of those purchasing suppressors in 2024, NSSF reported 35% were first-time purchasers—which points to the continued mainstream acceptance of a suppressor as just another firearm accessory.

Mainstreaming Suppressors

Wiliams joked that the recent increased consumer acceptance of suppressors is an “overnight success story 15 years in the making.”

Suppressors are not new, but the five-year 265% growth rate is. Where we are today is a product of a lot of work, on multiple fronts, that got us to this point.

Legally, citizens in 42 states can now own suppressors, and hunt with them in 41. That’s thanks to the state-level lobbying work of several organizations including ASA, NRA, NSSF and others. That alone opened up the market for huge growth in suppressors.

Of course, just because it became legal to purchase did not mean buying a suppressor was an easy process. That didn’t happen until the businesses like Silencer Central, Silencer Shop, and Capital Armory helped change the way consumers navigate the NFA paperwork requirements.

Helping consumers and dealers prepare and submit the requisite paperwork alleviated a lot of the headaches. But there were still delays at the federal level in the processing times of that paperwork.

Thanks to the vagaries of antiquated processes and political slow-walking, approval times once stretched to 18 months or more. That’s all changed in the last few years. By April 2023 the wait was down to nine months. This past July it took me a total of 17 days from the start of the buying process to receiving my can. That includes the seven days needed for local law enforcement to review, and a couple days where I simply dragged my feet through the process.

The reality is wait time is no longer a deterrent to buying a suppressor.

Two other aspects to mainstreaming suppressors for the average consumer are marketing and the wide availability of firearms with threaded barrels.

I spoke to Ernie Beckwith, CEO of Dead Air, and he walked me through some of what his company has done to expand their customer base. The first is obvious, though so frequently overlooked—or outright ignored by companies—and that’s putting your foot on the gas when sales surge.

Dead Air increased its marketing budget to build its brand, not just sell product. The company is putting time, resources, and money into building relationships with customers.

The second step is one we all witnessed last January, and that’s the very high-profile collaboration with Ruger on the RXD suppressors. Beckwith told me, “collaborating with Ruger expanded our brand exposure, and put a lot of new eyes on the category.”

Ruger is just one of many companies that has been making guns that accept muzzle devices, and that commitment has only grown. According to Ruger’s Product Strategy Manager, Tabor Bright, “the Ruger product team now talks about suppression in just about every applicable product conversation.”

The fact is that there are easily more firearms in circulation that are capable of accepting a suppressor than there are suppressors currently available to outfit them.

“Gun companies have been well ahead of the suppressor demand curve with models equipped with the threaded barrels,” observed Mark Keefe, editorial director for NRA Publications. “We’ve now reached a point where suppressors are no longer aspirational.”

“2026 is shaping up to be the year suppressors fully go mainstream, not just because of faster approvals, but because key barriers are falling at the same time,” said Cody Osborn, vice president of sales and marketing for suppressor manufacturer Q.

“Suppressors are no longer a long-term gamble or a psychological hurdle; they’re becoming a normal, repeatable purchase.”

Hunting Suppressed

Hunting is another area in which suppression is rapidly going mainstream. More and more people are hunting suppressed, thanks to ASA, NRA, and the Congressional Sportsmen’s Foundation (CSF) leading the charge to legalize hunting suppressed in 41 states.

NSSF’s study of suppressor consumers found 30% responded that hunting was their primary reason for purchase, coming in second behind recreational shooting (39%).

And this isn’t lost on suppressor makers. They’ve taken note and are responding with products specifically designed for hunters.

One takeaway from the Ruger collaboration, Beckwith said, was recognizing just how rapidly the hunting segment is growing. With new products coming out for the hunting market, Dead Air is positioning itself to meet the needs of those hunters.

The same is true at Q. “For hunters, the value proposition is straightforward and practical: reduced recoil, improved accuracy, better communication in the field, and a safer experience for guides, partners, and PHs,” Osborn explained. “Suppressors are increasingly viewed as ethical hunting equipment, not tactical accessories.”

“We expect continued growth in suppressor adoption among hunters, particularly as purpose-built platforms and calibers become more accessible.”

That won’t be an issue. At Ruger, Bright says that “one of the very first and most unanimous decisions the Ruger American product team made was that every American Gen 2 rifle would ship with a threaded muzzle—no exceptions.”

Many in the industry are already hunting suppressed, and not just those working for suppressor makers.

Peter Churchbourne, Executive Director of the NRA Foundation, and an avid hunter, has been hunting suppressed—where legal—since 2013 when “they were not widely used or even known about. Now there are 41 states where I can hunt.”

Projections

There’s little doubt that 2026 will be the Year of the Suppressor. Everything is coming together at the right time. The only question is how much growth will we see in 2026. On Friday, NSSF announced that it got word that ATF processed over 150k eForms on Jan. 1. The normal daily volume is closer to 2,500.

Buck Steele, President of Anechoic, sees 2026 as a year in which suppressor sales will double in volume over 2024 or 2025 numbers. He says the biggest growth segment will be the lower-priced $300 suppressors, where the removal of the Tax Stamp means there is no longer a 66% government markup.

Dead Air’s Beckwith sees a definite surge in sales, especially in Q1 and Q2, as those deterred by the $200 tax finally join the ranks of suppressor consumers. He believes after that we will see a leveling off to a new growth rate—but what exactly that will be is anybody’s guess.

One of the benefits of the removal of the Tax Stamp is that it opens the door to a constitutional challenge to the NFA. Williams says the ASA knew this all along, and viewed it as their fallback option to eliminating it through legislation, where 60 Senate votes are not there to invoke cloture, and end a filibuster.

ASA, along with the NRA, and the Second Amendment Foundation (SAF), are filing joint lawsuits. As are Gun Owners of America (GOA), Gun Owners Foundation (GOF), Palmetto State Armory, Firearms Regulatory Accountability Coalition, Silencer Shop and B&T USA in their own filing.

Williams admits this is “likely a multi-year process. A medium to long-term play that ASA and the others feel good about our likelihood of success.”

That would turn a suppressor purchase from a minor jumping through hoops to a simple 4473 transaction, like any firearm.

“But,” Williams says, “if you want a suppressor, don’t wait.”

What motivates consumers to buy a suppressor in 2026 might be a lot less complicated than we think. As Mark Keefe explained it, “The $200 Tax Stamp was essentially a poll tax on the exercise of the right to own a suppressor. When the poll tax was lifted, people voted. With the $200 Tax Stamp now gone, people are no longer financially discouraged from owning suppressors, and they will go out and exercise their right.”

— Paul Erhardt, Managing Editor, the Outdoor Wire Digital Network