Now that the news is formally out that Remington’s management is taking the radical step of bankruptcy to get rid of crushing debt service -and the owner (Cerberus) that essentially created that problem- there are plenty of emails and text messages flying around regarding the deal and players involved.

My first note was about my observation that the new owners of Remington will include investment groups Franklin Templeton and JP Morgan. The note accurately asked if anyone “really believes that they (Templeton and Morgan) will hold that equity for longer than they have to?”

Short answer: no. And more especially now in light of the tragedy in Florida. But it didn’t seem appropriate to make that kind of speculative observation before the deal had been filed. If the bankruptcy deal is approved, it will be a beginning, not an end of the business challenges Remington will still face.

But I’m hearing there are suitors already lining up for the chance to acquire that Remington equity - and the equity of “other publicly facing financial firms” who don’t want to own a piece of a firearms company.

In other words, the investors are willing to provide an exit means for investment groups with shareholders like the California Teachers Retirement Fund. They don’t want any fund they hold invested in gun companies- no matter what their financial performance indicates.

Many companies are crying the blues about an industry turndown. Others are continuing to quietly make money by tending their business. It’s a strategy that works.

Finally, a quick response to a financial analyst who accused me of taking a cheap (parting) shot at Cerberus over the Remington debacle. He pointed out that Cerberus has made investors lots of money on deals.

I’ll grant him that, but Remington will go down alongside Chrysler, Mervyn’s, ANC Rental (National and Alamo ownership group), and....GMAC financing.

In fairness, Cerberus isn’t the first speculative investment group to crash and burn in the firearms industry- just the latest.

In other industry news, one group that was severely criticized for their performance a decade ago is the Sands Expo Center in Las Vegas. When they first hosted a SHOT Show, it was said you could “still smell the exhaust fumes” in the garage areas they’d hastily converted into meeting space.

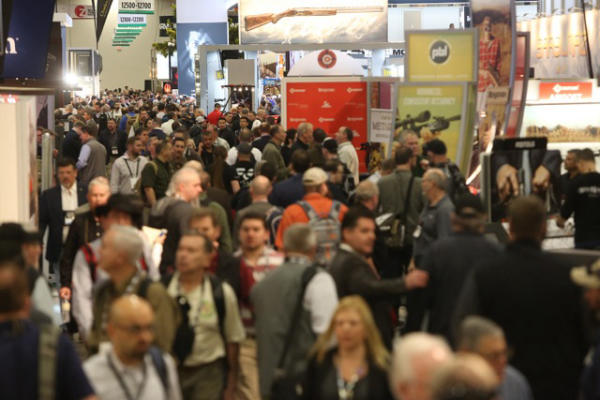

I remember that SHOT well- and it was an unmitigated navigational mess. But things have changed-for the better for attendees.

In recognition of those improvements, the NSSF has extended their deal with the Sands. That’s proof that positive change is possible- with cooperation. Not long before the fortieth SHOT Show convened in Las Vegas, plenty of people were wondering if SHOT would even be welcome there after last year’s shooting tragedy.

In Washington, the House has passed legislation that the Outdoor Industry Association (OIA) says will save outdoor companies millions of dollars. It’s called the Generalized System of Preferences (GSP) and it’s essentially a program that provides duty-free access to the U.S. markets for “certain eligible products” from 100 developing countries including the Philippines, Thailand and Indonesia.

The products list was expanded to include backpacks, duffels, and other travel goods last year by President Trump after a lobbying effort by OIA and outdoor companies. The change resulted in an estimated $90 million in savings.

That’s a lotta backpacks, duffels and “other travel goods”.

The GSP now moves to the Senate. As it does, we’ll keep you posted.

—Jim Shepherd